Average bank overdraft rates have more than doubled in the last year, following changes to borrowing rules, and some bank customers could now be charged up to 50% interest.

The changes to overdraft fees were due to come into force this April, but were postponed until the summer because of COVID-19. For many people, this means higher monthly overdraft charges at the worst time, just as the furlough scheme is coming to an end and unemployment is on the increase. Bank customers with a poor credit history could now end up paying a whopping 49.9% interest on their overdrafts!

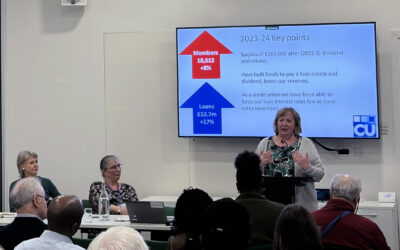

That’s why we’re urging people to clear their overdrafts with one of our fair and affordable Saver Loans. With interest rates starting at 12.7% on the reducing balance of the loan, up to £20,000, our Saver Loan is a cheaper and more transparent way to borrow.

You can apply for a loan today, but often we will reward you with even lower interest rates if you have saved with us first. Having saved with us first also greatly increases the chances of your application being approved.

To apply for a Saver Loan, you must first join the Credit Union as a member. When your loan is approved, and if you are not already a member, you must open your account with a minimum £50 deposit to your savings account.

The granting of the loan is based upon evidence of affordability. Unlike other lenders we will not judge you if you have had financial problems in the past, nor will we encourage you to borrow more than you need or can afford.

Interest on most Saver Loans is charged at a fixed typical rate of 12.7% APR. Rates may vary depending on our lending risk criteria, so if you have experienced problems with debt previously, this is not necessarily a barrier to getting a loan from us, but may mean a slightly higher interest rate.

In addition, our unique Saver Loan sees part of your regular repayments allocated to your Credit Union savings account. which means that as you repay your loan your savings grow too. You can access your savings once the loan is repaid and this Saver Loan principle means that you gradually reduce and ultimately eliminate your need to borrow.

“Our Saver Loan is a much more affordable way to borrow than bank overdrafts, which now have even higher rates of interest,” explains Martin Groombridge, Credit Union Chief Executive. “With our Saver Loan, you can borrow what you need now to pay off your overdraft, and then repay your loan from us over an agreed period that suits you. With no hidden charges or catches, it’s the best way to borrow!”