If you have some spare savings, then maybe you could consider making a Community Investment in the Credit Union as a way of benefitting your community.

Credit unions are co-operatives formed on the basis of mutual self-help rather than charity. They encourage saving rather than borrowing, with the savings being pooled and ‘reinvested’ into the community in the form of low cost ‘Saver Loans’. These low cost loans can then be accessed as an alternative to high interest credit used by less advantaged people in our communities.

Credit Union Director Elisabetta Bertero said: “By making a Community Investment in the Credit Union, not only are you providing us with much needed funds to support more people, but you are helping to provide a lifeline to our communities, keeping people out of the clutches of loan sharks and high cost lenders, and preventing them from getting into a spiral of debt.”

For many people, the ability to borrow money can make the crucial difference in being able to replace a broken cooker, fridge or simply being able to buy school uniforms for the kids. More and more people are having to take out loans and a lack of options means that they are often forced to turn to high interest lenders. With some companies charging huge APRs, these loans cost people a fortune and often leave them unable to buy basic foodstuffs.

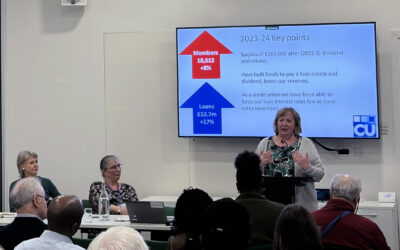

Access to the Credit Union’s low cost credit is essential for such people. Our Saver Loan is lent at a typical rate of just 12.7% APR on the reducing balance and greatly reduces the costs of borrowing for some of society’s poorest members.

Recent financial analysis concluded that for every £1 we lend to members, they save a full £1.25 over the course of a year in interest payments, bank charges and fees. That means a £1,000 Community Investment in the Credit Union could provide a community benefit to borrowers of £1,250 after one year, £2,500 after two years and £3,750 after three years.

It costs nothing to make a Community Investment. The money you invest remains your money and can be withdrawn on demand, normally within five working days. Savers are also paid an annual dividend on their savings, which is a distribution of surplus in the lending business. Savings with the Credit Union are protected under the Financial Services Compensation Scheme.

To find out more about making a Community Investment in the Credit Union, and to download the application form, click here.