Now that more of us are being encouraged to return to our offices and workplaces, the issue of transport costs raises its head again. Rail, bus and tube fares can soon mount up for those who live and work in London, but the Credit Union can help…

Travelling around London is an expensive business. In fact, a 2017 report revealed that public transport in London is the most expensive in the world! No wonder travel costs take up such a huge chunk of our hard-earned wages, and for some of us paying for travel can be a real struggle.

The cost of annual travelcards, season tickets and bus passes can really add up, but rather than lumping them on to your credit card and paying high rates of interest on the debt, why not consider a Credit Union loan instead?

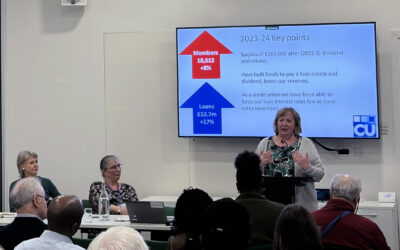

We offer Saver Loans of up to £25,000 (although lower limits apply for first time borrowers) at very competitive rates of interest, to be repaid over a period of time to suit you.

One of the great things about our Saver Loans is that part of your regular repayment is allocated to your savings account which means that, as you repay your loan, your savings continue to grow. You can access your savings once the loan is repaid. This Saver Loan principle means that you can gradually reduce and ultimately eliminate your need to borrow.

We offer a whole range of other low cost loans for our members, so even if you don’t need to borrow from us now, it makes sense to join the Credit Union, so you can benefit in future, should the need arise.

Alternatively, why not open a Credit Union savings account specifically for your travel costs?

You can save as much or as little as you like with the Credit Union, but it might be worth working out how much you are likely to need each year for travel and then putting away enough each week or month to cover the cost. You can then withdraw your savings when you need them.

In addition, if you’re an employee of one of the organisations that participate in our Salary Savings Scheme, it couldn’t be easier to save with us, as your savings can be deducted directly from your salary.

Credit Union Chief Executive Martin Groombridge said: “Living and working in London is an expensive business, and finding the money to pay for your travel costs can be a real headache. That’s why we would urge people to talk to the Credit Union – we can help with your transport and travel costs, keeping you on the move!”

Find out more about joining the Credit Union to access low cost loans and ethical savings.