The pandemic brought home to many of us just how important it can be to have some savings to fall back on. Whether you need a nest egg for a rainy day or enough for a new kitchen, putting some money into a Credit Union savings account each month can make a massive difference.

The Credit Union offers a range of flexible savings accounts to meet your needs. You can make a lump sum deposit, or you can start a regular savings plan for as much or as little as you like, although we usually recommend at least £20 a month.

We offer multiple ‘budgeting accounts’ to help you save for special occasions, important life events or major expenses. This includes things such as Christmas, holidays, funerals, pets & vets or a new car. Our PrizeSaver account offers savers the chance to win up to £5,000 per month and the more you save, the more chance you have of winning. We also offer children’s accounts.

You can save by standing order or direct debit directly from your bank account and employees of the many organisations that participate in our Salary Savings Scheme can have savings deducted directly from their salary.

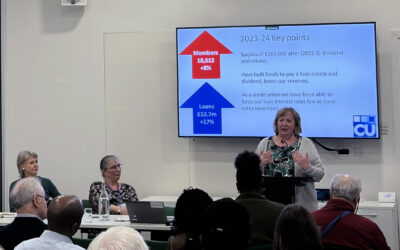

We don’t pay interest on savings accounts as such, but we distribute any trading surplus to our members as a dividend calculated on average savings each year. (In a credit union like ours, every £1 of a member’s savings is a £1 share in our financial co-operative, and we often use the terms ‘shares’ and ‘savings’ interchangeably.)

And what’s more, when you open a savings account with the credit union, you will be doing your bit to help some of the most vulnerable in our communities. The money our members save with us is put to good use providing much-needed low cost loans to those who may otherwise fall prey to loan sharks, payday lenders and other high cost lenders.

Credit Union Director Helen Baron said: “If you’re looking for a safe and ethical place to keep your hard-earned savings, you’ve come to the right place. You can be confident that, when you save with us, your money is being put to good use providing a low cost alternative to high interest loans and helping thousands of people escape from debt.”

Click here to join us today and to find out more about saving with us click here.