As life begins to get back to normal after lockdown, we’re urging people not to turn to loan sharks, high-cost lenders or expensive credit card debt, but to talk to us instead if they need some help to make ends meet.

For many households, lockdown was an opportunity to save money, as we travelled less, stopped eating out and going on holiday, worked from home or did school lessons online. However, now things are getting back to normal, the bills are rocketing again.

According to research from Nationwide Building Society, spending transactions in the second quarter of 2021 were up by 20% compared to the first quarter. This shows that for many of us expenses are on the increase and, for some people, finding the money could become a struggle.

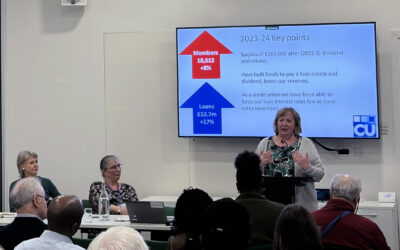

At the Credit Union, we would never encourage people to borrow more than they need or can afford, but our low cost loans are a lifeline for many.

We offer Credit Union Saver Loans up to £25,000 (although lower limits apply for first time borrowers) at very competitive rates of interest, to be repaid over a period of time to suit you.

One of the great things about our Saver Loans is that part of your regular repayment is allocated to your savings account which means that, as you repay your loan, your savings continue to grow. You can access your savings once the loan is repaid. This Saver Loan principle means that you gradually reduce and ultimately eliminate your need to borrow.

Our Saver Loan is charged at a fixed typical rate of 12.7% APR, which means that £1,001 repaid monthly over a year would cost just £67 in interest.

Credit Union Director Paul Campy said: “Now things are getting back to normal, the pressure on us all to spend more is increasing. If you need a little extra to get by, don’t turn to high cost lenders, but talk to us instead. We offer a whole range of low cost loans for our members and we’re here to help whenever you need us.”

Click here to find out more about our low cost loans, and to find out about joining the Credit Union, click here.