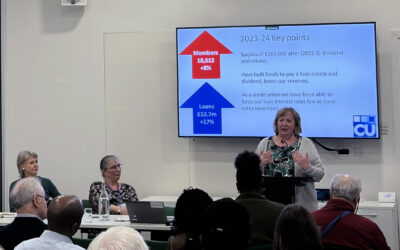

Credit Union President Helen Baron looks back at how things went for the Credit Union over the last 12 months.

It has been another difficult year at the Credit Union, but we have continued to provide as much support as we can for our members, and we are indebted to our dedicated staff, who have maintained our services and adapted quickly to changing guidance and member needs.

While we have had to continue to limit visits to the office, we have been open via the telephone and on our ever-improving digital platforms for those who need to make withdrawals or apply for a loan. You may have noticed the changes that we have made to our website – we hope you have found the new design and increased functionality clearer and easier to use.

The pandemic, and the resulting economic turbulence, has affected members differently. Some have been able to increase their savings and pay off their loans – often because of reduced spending. Yet we know that many members have faced financial challenges with work being uncertain or drying up altogether.

Do remember that if you are having difficulty paying off your loan, you just need to talk to us. We understand these are difficult times and we are there to help. The economic uncertainty has definitely shown the value of having even a small savings pot – it can really help deal with the unexpected.

Demand for loans dropped substantially at the beginning of the pandemic, but now we are seeing some recovery as people are getting back to normal activities. Our loan rates are very competitive and anyone who has over-extended over Christmas or needs money other reasons, should think about taking a Credit Union loan rather than using payday lenders or paying high interest on credit cards and bank overdrafts.

Financially this has been a good year for the Credit Union. With much excellent work from our credit control staff, the accounts show a surplus which we can use to strengthen our reserves and to pay a dividend and loan interest rebate to members. If, as we all hope, life will return to normal over the next year, we will be in a good position to return to growth.

I cannot finish without thanking all the staff and volunteers (including my fellow directors) whose hard work keeps our Credit Union going. Lastly, I would like to thank you for supporting the Credit Union. Please do tell your friends about us and encourage them to join to enjoy our services.

To read Helen’s report in full, and to download our Annual Report for 2020-21, click here.