Following our AGM on 13th February 2020 and the publication of our latest Annual Report, President Helen Baron gives an overview of the Credit Union’s activity for the financial year to the end of September 2019.

The last year was one of further consolidation. In previous years’ annual reports, we highlighted the challenge in meeting the required large increase in capital asset ratio. In those reports we stressed that meeting these targets without external support would be extremely difficult and impact adversely on meeting our social objectives. It gives us no pleasure to say that those forecasts have proven correct.

We are reporting a small financial loss for the year. Three years ago, in preparation for the requirement for increased capital we took steps to tighten our lending policy and reduce our costs. This meant taking less risk in lending and increasing interest rates on some of our loans. As a result, our loan book decreased in value for the second year running after many years of rapid growth.

One of our key successes this year has been the continued expansion of our Salary Savings Schemes with a number of employers, most notably Great Ormond Street Children’s Hospital. Many employers agree with us that it is better to save for things than borrow and these schemes greatly increase the number of people saving for a rainy day. Staff also gain access to our support services and ethical and low-cost credit if they need it.

During the year the regulators approved the rule change agreed at our AGM in February 2019. Membership of the Credit Union is now additionally open to the boroughs of Brent, Enfield and Waltham Forest. Anyone living or working in the following boroughs can join us: Barnet, Brent, Camden, City of London, Enfield, Hackney, Haringey, Islington & Waltham Forest.

The continuing roll out of Universal Credit has caused well publicised financial problems for many of our members. Delays to people receiving their Universal Credit causes very real hardship to people in desperate need. The Credit Union has seen a significant rise in small value loans to help people through the period as they move onto this new benefit.

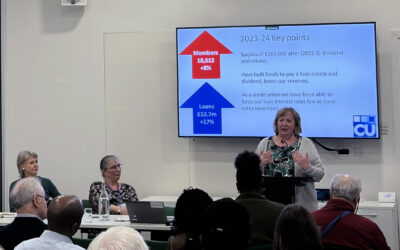

At the end of the period our key figures stood as follows:

- Membership rose slightly to 15,629

- Savings/share balances rose to £13,154,000

- Loans balances reduced to £9,654,000

Despite a nearly 10% reduction in our loan book we saw a relatively small reduction of 1% in loan interest income. This was due to increases in some loan rates with the introduction of risk-based pricing. Our typical loan rate remains at 12.7% APR, significantly lower than most credit unions and compares well with a typical UK credit card rate of 20%.

The latest operating loss marginally reduced our reserves, and we still face a very real challenge to meet the requirement of the Prudential Regulation Authority to hold significantly higher levels of capital. We are now actively marketing deferred shares through the Ethex ethical investment platform and actively seeking subordinated loans to help strengthen our capital position in order to resume our expansion.

During the year we have seen an increasing proportion of our business being conducted through the members’ secure area of our website and app for mobile devices. These online services speed up access to our services and increase the time our staff can make available to those members who need help with things like completing forms and budgeting.

Click here to download our Annual Report 2018-19, which includes a more detailed review of the Credit Union’s activity.