In advance of our AGM on 25 March and following the publication of our Annual Report 2019-20, here is a short review of the Credit Union year to the end of September 2020.

This has been a difficult year for the Credit Union, as it has been for everyone. Credit Unions were designated an essential service, which means we were able to remain open throughout the different lockdowns to ensure that our members had access to their savings or could apply for loans if needed. Thanks are due to our dedicated staff, who very quickly managed to make arrangements to keep the office going in a safe manner and maintain our services.

Over the last few years, we have been increasing and improving access to Credit Union accounts via the internet or a phone app as well as by telephone and this helped a lot in keeping our services going. We are continuing to operate in a Covid-safe manner and encourage members to access their accounts digitally where possible. We have maintained normal hours for phone contact. In-person visits to the office are not possible but we can help you over the phone or by post.

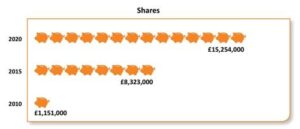

We have noticed that a lot of members are saving more, perhaps because they are spending less during lockdown. The economic uncertainty that the virus brought certainly made it clear that even a small savings pot can really help deal with the unexpected. We know some members may be facing a drop in income or even redundancy, so if you are having difficulty making payments on a loan – do get in touch with us. We want to understand your situation and can be flexible in adjusting payments. We understand these are difficult times and we are there to help.

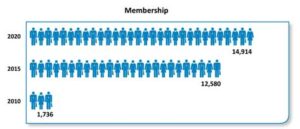

While we have managed to keep services running, we have not been able to grow the Credit Union as we had planned. For several years our ability to grow was limited by the need to hold a high level of capital reserves. We were excited in March when our regulator finally reduced these limits to more reasonable levels, only to be hit by the lockdown. Now that it looks like we will soon have a vaccine and we can begin to see the end of lockdowns we will be revising our plans.

We know that the next year or two may be difficult for many of our members and we want to be there to help. Of course, you don’t have to be in financial difficulty to use our services. Our loan rates are very competitive and anyone who has overextended over Christmas or wants some money for a holiday when travel becomes possible again, should think about taking a credit union loan rather than using payday lenders or paying high interest on credit cards and bank overdrafts.

Credit Union President Helen Baron said: “I would like to thank all the staff and volunteers at the Credit Union, including my fellow directors, whose hard work keeps our credit union going. I would also like to thank you for supporting the credit union. Please do tell your friends about us, and encourage them to join to enjoy our services too!”

For more detailed information, click here to download our annual report.