London Capital Credit Union is urging City investors to invest in its deferred share scheme, which aims to tackle the issue of loan sharks and illegal money lending head on.

Based in Archway, our Credit Union exists to help members save and to lend them money when needed at reasonable interest rates so they can steer clear of payday lenders and loan sharks, and we are looking to expand.

Martin Groombridge, Chief Executive of the Credit Union, said: “We aim to raise £125,000 to £150,000 in additional capital through an issue of deferred shares. This will allow the continuing expansion of our lending as an alternative to loan sharks and other high cost credit providers. A social investment in deferred shares will have a significant positive impact on the communities that we serve, including those in the City’s poorest neighbourhoods.”

For some sections of the community, including the ‘working poor’, there are very few opportunities to access affordable credit. That’s where credit unions come in.

Regulated by the FCA and PRA, credit unions in the UK tend to operate in those areas of the market not well served by mainstream financial institutions. As members’ incomes are usually lower than average, a credit union’s main competitors are likely to be niche players offering high-interest loans to those with poor credit profiles.

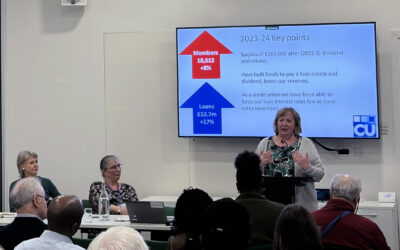

One of the country’s fastest growing credit unions, London Capital Credit Union has gone from 675 members and £493,000 on loan in 2008 to over 15,000 members and over £10.8m on loan at the end of 2018.

The Credit Union plays a significant role in alleviating poverty (as the Joseph Rowntree Foundation has identified) and has an ambitious expansion programme. It is looking to extend its services to tens of thousands more people, so as to reduce financial exclusion and the level of poverty in the community.

Social and financial impact

Increased use of credit unions could have a real impact on local communities. Analysts from a well-known City institution performed an assessment of the social and financial impact of London Capital Credit Union and concluded that, on average, for every pound lent to clear existing debts, members save £1.25 each year in interest, bank charges and fees.

A single investment in deferred shares provides ongoing benefits far beyond the amount invested. With the regulatory requirement for credit unions to hold capital representing 10% of their assets, an investment of £100,000 of deferred shares would allow £1 million to be lent and leads to £1.25 million in benefits to members in a single year.

Over four years, the Credit Union’s members could save some £5 million of loan costs. This is money that is likely to stay in the community, benefitting local businesses and supporting local employment.

Martin Groombridge added: “The concept of social enterprise and social investment is tried and tested, proven to bring real benefits to our communities. The launch of our deferred shares provides social investors with a practical way of helping more people escape from high cost debt.”

Investors looking to make a difference to the local community can find out more and apply for shares here.